Global Scans · Dynamic Pricing · Signal Scanner

Emerging Disruption in AI-Powered Dynamic Pricing: The Commoditization and Algorithmic Complexity Wave

Dynamic pricing powered by artificial intelligence (AI) is evolving rapidly, driven by advances in large language models (LLMs), algorithmic pricing scrutiny, and real-time data integration. A subtle signal currently gaining momentum is the commoditization of foundational AI capabilities, which may trigger a collapse of traditional AI pricing models. This could upend existing industry structures that rely on proprietary AI for competitive advantage, particularly in retail, transportation, energy, and financial services. This article explores these nascent shifts, their drivers, and the broad implications of AI-mediated algorithmic pricing entering a new phase of complexity and disruption.

What’s Changing?

The year 2025 and beyond is shaping as a critical juncture for AI-enabled dynamic pricing. Several interrelated developments suggest a convergence of forces that may form an emerging trend with widespread impact:

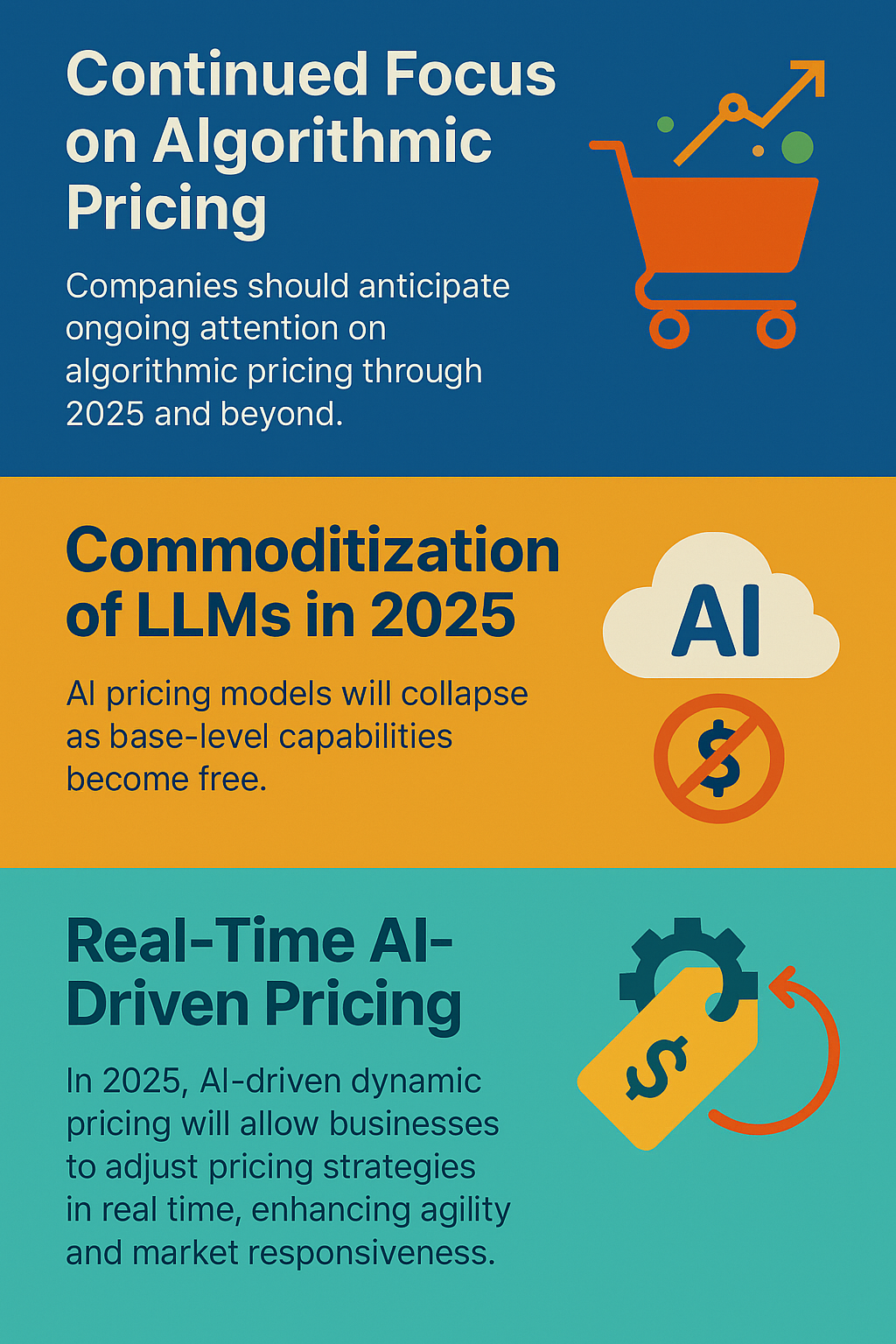

- Commoditization of Large Language Models (LLMs): By 2025, leading technology firms like IBM, Google Cloud, and SAS predict that LLMs will become widely accessible at no cost for basic functionalities (The AI Innovator). When basic AI building blocks are freely available, pricing models based on proprietary AI could dissolve, forcing companies to rethink value extraction.

- Intensifying Regulatory Attention on Algorithmic Pricing: Antitrust watchdogs are expected to maintain rigorous scrutiny of algorithmic pricing strategies due to concerns about price collusion and market fairness (Wilson Sonsini Goodrich & Rosati). This elevated oversight may constrain aggressive algorithmic price setting while encouraging transparency and innovation in pricing algorithms.

- AI Pricing Wars and Margin Pressure: The unexpected market disruption caused by DeepSeek—a company leveraging aggressive AI-driven pricing—has stirred fears of a pricing war that could compress margins for U.S.-based AI firms (Forbes). Such dynamics could pressure players in sectors like retail, ride-hailing, and cloud services to revise their business models.

- Retail Sector AI Mediation: Projections show that by 2027, over 80% of retail interactions will be AI-mediated, including the use of chatbots and rapid dynamic pricing algorithms adjusting deals in milliseconds (Ian Khan). Retailers could face novel operational challenges balancing velocity, customer satisfaction, and regulatory boundaries on pricing ethics.

- Expansion of Dynamic Pricing in Transportation and Energy: AI applications forecasting demand and adjusting ride-hailing prices dynamically are already in use, with companies like Uber at the forefront (IMG Global Infotech). Similarly, smart meters facilitating dynamic, customer-centric energy management are expected to grow substantially, underpinning a new pricing ecosystem in energy markets (OpenPR).

Together, these facets outline a future where AI-driven pricing complexity deepens, commoditization removes old AI advantage barriers, and regulatory frameworks recalibrate pricing strategy boundaries.

Why Is This Important?

The commoditization of core AI capabilities could drastically alter market dynamics. Currently, specialized AI models provide companies with pricing power and competitive differentiation. If foundational AI becomes freely available and commoditized, organizations may lose this edge, facing intensified price competition and narrower margins.

Simultaneously, increasing regulatory attention could require companies to embed compliance innovation into pricing algorithms, pushing transparency and preventing anti-competitive behavior. Such oversight shifts are particularly significant in sectors like energy and retail, where consumer impact is immediate and visible.

The rapid increase in AI-powered retail mediation and dynamic pricing might redefine customer experience expectations. Businesses might be compelled to prioritize both ethical pricing and real-time responsiveness while managing operational complexity and public perception.

Transportation and energy sectors integrating AI-driven dynamic pricing face broad societal and infrastructure implications, including fairness in pricing access, grid stability, and economic inclusivity.

Implications

The unfolding commoditization trend signals that industries leveraging dynamic pricing need to anticipate a reset in how AI value is extracted and monetized. Several implications arise:

- Strategic Differentiation Will Shift from AI Models to Data and Context: With base LLMs and algorithms becoming freely accessible, proprietary data, real-time context awareness, and integration with sector-specific workflows may become the primary competitive moat.

- New Pricing Models Could Become More Fluid and Multidimensional: Dynamic pricing may evolve beyond simple demand-supply calculus to integrate social equity, regulatory compliance, environmental impact, and customer lifetime value simultaneously, requiring more sophisticated modeling and stakeholder coordination.

- Operational Complexity and Risks Will Increase: Faster pricing adjustments enabled by AI could amplify risks related to price volatility, customer backlash, and potential regulatory violations, requiring improved governance frameworks for algorithm oversight.

- Cross-Industry Collaboration Might Intensify: Addressing algorithmic pricing fairness and transparency could drive new partnerships across industry, government, and civil society to co-design responsible AI pricing frameworks adaptable to multiple sectors.

- Investment in Explainable AI and Compliance Tools Will Rise: Firms might prioritize technology that explains pricing decisions transparently to regulators and customers, embedding accountability as a core capability.

Early movers who study these shifts and redesign strategic plans to leverage commoditized technology while innovating on data, compliance, and customer experience could gain significant advantage. Meanwhile, those relying heavily on proprietary AI pricing models may face erosion of their value proposition.

Questions

- How can organizations leverage freely available AI models while protecting competitive advantage through unique data or integration?

- What governance structures are needed to ensure ethical and transparent dynamic pricing within intensified regulatory scrutiny?

- In what ways could pricing algorithms integrate broader stakeholder interests, including social equity and environmental sustainability?

- Which collaborative models might accelerate the development of industry-wide standards or shared frameworks for AI-driven pricing?

- How can firms balance rapid pricing agility with minimized risks of public backlash or regulatory violations?

Keywords: AI commoditization; Dynamic pricing; Algorithmic pricing; LLM; Regulation; Retail AI; Energy management; Transportation AI

Bibliography

- Companies should anticipate continued attention on algorithmic pricing into 2025 and beyond. Wilson Sonsini Goodrich & Rosati. https://www.wsgr.com/en/insights/2025-year-in-preview-antitrust-trends-and-key-decisions-in-private-litigation.html

- The sudden rise of DeepSeek caused uncertainty, with investors fearing a potential AI pricing war that could impact margins for U.S. AI firms. Forbes. https://www.forbes.com/sites/markminevich/2025/02/06/the-6-million-ai-bombshell-how-deepseek-shook-wall-street-and-ai-leadership/

- In 2025, LLMs will become commoditized, leading to AI pricing models collapsing as base-level capabilities are offered for free. The AI Innovator. https://theaiinnovator.com/2025-ai-predictions-from-ibm-google-cloud-sas/

- By 2027, over 80% of retail interactions will be AI-mediated, from chatbots handling inquiries to dynamic pricing algorithms adjusting deals in milliseconds. Ian Khan. https://www.iankhan.com/singles-day-2025-how-ai-and-iot-are-reshaping-retail-tech-deals/

- Uber uses artificial intelligence to forecast demand for ride-hailing, determine dynamic pricing, and recommend optimal routes for its drivers. IMG Global Infotech. https://www.imgglobalinfotech.com/blog/ai-in-transportation

- The ongoing shift toward renewable integration, dynamic pricing, and customer-centric energy management will ensure that smart meters remain at the heart of the world's energy transition. OpenPR. https://www.openpr.com/news/4280459/smart-meter-market-to-exceed-usd-64-3-billion-by-2035-meticulous